AT&T is a major carrier in the US for cell service, and they also have financial interest in NFL Sunday Ticket, which I love, and Time Warner, CNN, which I loathe. Whether I love or hate AT&T, I don’t care. What matters is that they have a predictable business for the most part, and I feel I can generate some gains using their stock as an instrument.

Honestly, I don’t buy into the concept that you have to approve of the company you want to invest in, in come cases that could be a detriment. I know that, because some of the investments I have held is because I personally “like” what the company does, but that can cloud judgment when it’s time to be bearish.

With AT&T the reasons I decided to invest in it are because it has ALL of the key elements I like.

- Overall stability as a company.

- Weekly options are available, not just monthly.

- Volatile moves in stock price from week to week allow for attractive option plays.

- Relatively low stock price which allows larger option blocks to be traded.

- Dividend paying stocks provide income while cycling up and down.

Strategy Getting Started

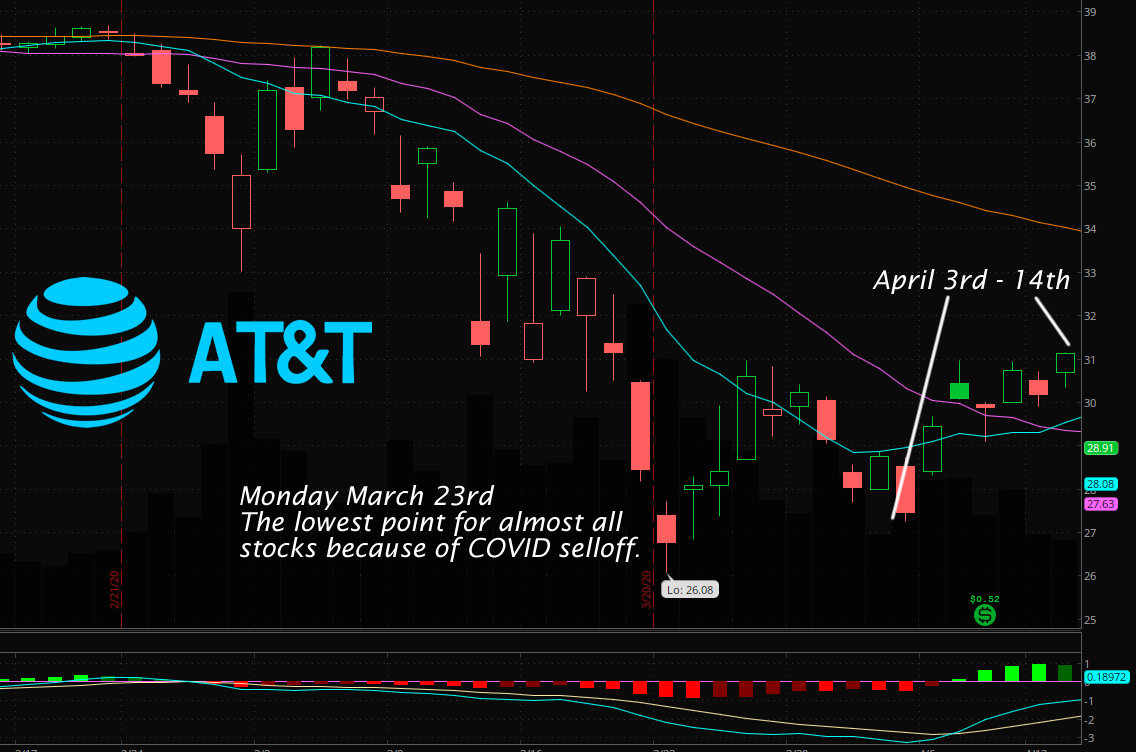

Obviously at the beginning, I had no position in AT&T. Deciding whether I was bullish, or bearish was based on the situation at the time. It was a time just weeks after the great COVID collapse of the market where everything was sold. “The baby was thrown out with the bathwater” for almost everything, and AT&T was no exception. Here is a chart showing the performance at the time.

Here you can see it’s meteoric drop from as high as $38 per share, down to a low of $26, then a wobbly road back up a little. At this point, my viewpoint was that AT&T would stage a recovery. Although the price was at about $31 on April 14th, I decided to take a cautious approach and basically say “I would buy it at $29 on April 24th if it’s below $29. Otherwise, I am not interested”.

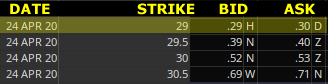

Still stir-crazy from being held up in the house for a month because of lockdowns on workplaces etc, I was gun-shy to take a full on bullish approach so I used a pullback point of $29. Now, because things were still volatile, the PUT option price still had a decent bid, here’s the grid at about 8:30am on April 17th (a Friday).

The bid was .29 and the ask was .30. I sold 10 PUT contracts at a strike of $29.

What does that mean? It meant that I take the risk that I may have to buy 1000 shares of AT&T on April 24th if the price closed below $29.

The full value of the transaction is established like this:

10 (contracts) x 100 (shares per contract) x $0.29 = $290 dollars.

After commissions from the brokerage, I ended up with a deposit given to me of $282.30.

So now what? There’s 7 days between now, and Apr 24th when this would “close”. What could happen? It could drop again like 1 month before, or it could shoot up, or just wander. Here’s a chart of how it worked out up until April 24th.

So it got pretty close there for a bit on Friday April 24th. See how the price dipped down to $29.15 at one point. The sphincter muscles begin to contract a little at this point because it’s like “Ok, this is going to happen, I am going to end up getting assigned this thing, and then what?” (now that’s not a bad thing, as you will see later as this works out) However, the market had other things in mind, and the price shot upwards, and the option contracts I made a week prior “expired worthless”. This means all the cash received a week ago is a fully “realized gain” and stays in my account as cash.

Pretty cool eh? $282 made for just taking on the possibility that I might have to buy some stock. That seems easy. $0 invested, $282 gained. You can’t even begin to calculate the % of return on that right? Wrong! One has to still consider that the capital risked ($29,000 dollars) was a real thing. So at this point, the $282 gain, weighed against the possible risk that was agreed to is a 0.9% gain over 7 days. Annualized, that’s something like a 50.5% return, but only someone trying to pump their numbers would try to say something like that.

Who am I trying to kid, it’s only slightly less than $300. So now what. Like a strong philosophy I live by says “when the good times are going, keep em going”. So lets do this again.

This situation was a little different. There was only 1 day left between “now” and the expiry date I was focusing on that days “tomorrow” which was May 8th. Here’s the strategy, now I am thinking, “sheesh, I actually do want to buy this thing, so lets see if I can get “assigned” this time. I will do a contract for tomorrow, at $29 again, and this time the price was $0.26 just a little less than the last one, but that’s because of two factors. 1) We’re a lot closer to the $29 strike price than the other time, and also 2) We’re only 1 day away from the expiration of the contract so there’s not much “time” value left in the contract.

Here’s how the contract looked:

10 (contracts) x 100 (shares per contract) x $0.26 = $260 dollars.

Net credit after commissions was $253.30

Since the value of AT&T rose again on Friday, the contract ended up “expiring worthless” again. By now, you’re noticing that the words “expiring worthless” are a good thing when you’re the seller of a contract. There is an accumulated $535 in “realized gains” now, and we’ve never even bought the stock yet. This is just a bit cooler than the last time right? Time to let it ride, and try it again? That’s the losers creed in Las Vegas, but here it’s different. We’re going to find out how the snake can turn around on you, and also, how to charm the snake back into his hole.

Round 3

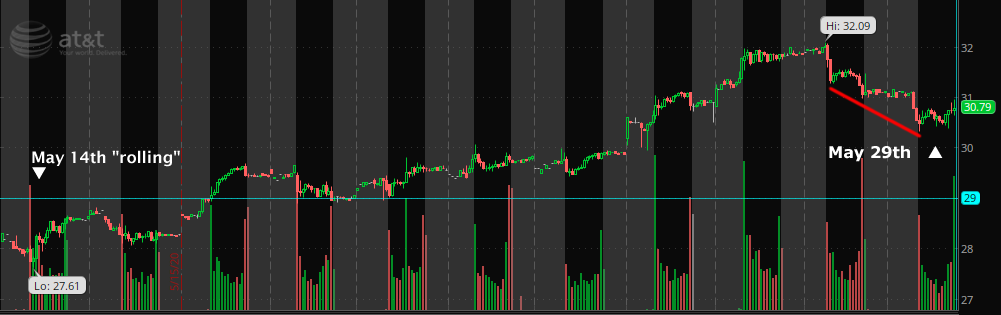

The date now is May 13th, and time to go back to the well once more. This time things would not work out so perfect, and we’d have to employ a new maneuver called “rolling”.

This is when I had that “oh crap” moment like when Han Solo says “I have a bad feeling about this“. Time to employ a tactic known as rolling the PUT forward. This helps me avoid the obligation of buying the stock today, and I “put” it off for another day.

This means having to buy back the contract sold, and sell it again, but to a future date. The positive aspect of this is that no matter what the contract price is in the “today” moment, it will always be worth more in a future week/month. So, here is how the rolling transactions happened to get out of this tight spot. (Although really, buying AT&T at that point wouldn’t have been a disaster either, I just wanted to keep riding the free money train a little longer)

May 13th (initial contract date)

–10 x 100 x $0.71 = $703.29 (credit)

+10 x 100 x $0.71 = $1,296.67 (debit)

Original contract is closed, really for a net “debit” or loss of cash, of $593.

Now to roll into a new contract for May 29th, and recoup that debit, and hopefully turn it into an overall credit.

-10 x 100 x $1.57 = $1,563.28 (credit)

How would this all work out? Pretty good actually, and this is where patience has to figure in to our psyke because as time goes on, things tend to move around, sometimes in your favor, and sometimes out of it.

LEG 4 RESULTS

From the day that I rolled the PUT contracts forward to May 29th, AT&T went on a tear, and one could say, “Dude! You should have let yourself get assigned at $29, you’d have made good money up at $32” and he’d be right. The truth is, nobody ever knows what is going to happen in the future, and hindsight is 20/20. The name of this game is, and always should be “realized gains” and a two week period does not make a forever future as we will see as this continues, and the price eventually fluctuates down pretty low.

Ok, so what happened on May 29th. In the morning, we can see that the trend from Wednesday afternoon, through Thursday, and into Friday May 29th was a strong downtrend. Not wanting to see my gains disappear, I decided to close that big $1563 contract and hold on to the gains. This is because at 9am, I have no idea if that downtrend will continue, or hold above $29. It should have, because it was still above $30, but I though, “it dropped a whole dollar the day before, who’s to say it can’t happen again today” So at a tiny price of $0.03 I closed the contract, and that cost about $30 dollars to do. In reality, a tiny price to pay for peace of mind, and lock in a for sure $1,533 gain.

CUSTOM TRACKING SOFTWARE

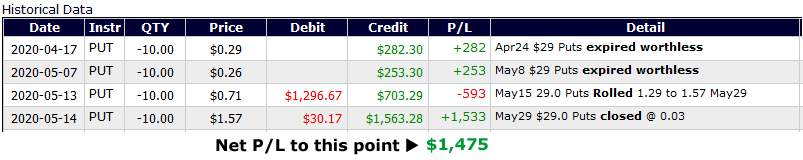

During the lock-downs of April where for the most part, nobody around here was working, unless you worked in a grocery store, or some sort of “essential business”. I spent some quiet time to make my own software that basically works like Microsoft Excel, but with some custom twists of my own. I needed it to be able to keep up with the whole compartmentalization of not only stocks and options, but a concept I was training myself which is to consider them all individual “blocks” of investments. This way I could think of bits of investment instruments as smaller fragments of the little picture within the big picture. Here’s a cropped screenshot of tracking AT&T PUT options for the two month period from April to May. The idea here is that I continue to track every transaction, and how it’s working, and how it worked out. The online software of the brokerages doesn’t display things in this manner, and it’s always just moving on to whatever your “current” position is, and how it’s faring. There’s more to it than what is shown here, but this is a “log” portion where I list how each transaction worked out, considering commissions, and any fees taken by the brokerage.

4 total “transaction groups” have now been opened, and either been expired, rolled, or closed. In total, $1,475 has been earned, and closed to be fully realized gains. We can almost start calculating a return on investment, because roughly two months have gone by, well, a little less. But if we use 2 months as the term, we’ve made a return of 5% now, on only the risk of having to invest $29K, but never have had to actually do it. 5% in only 2 months is really 30% annually. As always though, you can’t count your chickens before they hatch, and because technically, at this point we’re “out” of AT&T, not holding any position, it’s sort of escaping us as it moves onward and upward of $30.

One could argue that just buying and selling stock would have earned more, and they’re right, but you’d have to employ a different set of skills in day-trading, swing trading, and probably more likely being absolutely glued to your monitor for the entire sessions to be able to pick out when to buy, and when to sell. I have tried day-trading and it’s not for me. I have had success at it, and failure at it, but all things being equal, the adrenaline is not for me. I like to be patient, and use a different approach.

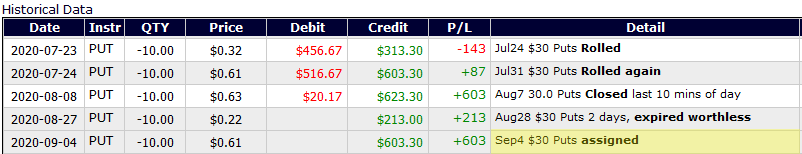

EVENTUAL ASSIGNMENT

For a little over a month, my attention was turned away from AT&T while I attended to some other areas in my funds. Along comes the end of July and I decided I would begin to explore the $30 strike range, and ended up having to “roll” twice before actually being assigned on September 4th.

“Being Assigned” sounds a bit ominous, but it’s not. It basically means, “you bought the stock you have been flirting with on those naked PUTs. Hmmm, it almost sounds dirty when I say it like that. Whatever, on that date, BAM! The shares are “PUT” into the account, and the cash required to buy them, is taken out.

Once I got assigned, and accepted owning the stock, the game changes. What can I do now to generate some income while owning this stock?

THE SQUEEZE PLAY

In Baseball when there’s a runner on 3rd base, and the batter hits a bunt, it’s called the “Squeeze Play.” He totally expects to be out at first, but the runner scores, so it’s worth it. There’s a move I make once owning a stock that I call the “SQUEEZE” because basically, I am going to now put a pair of options in motion, with the block of shares in the middle. Either they’re going to sell at the strike price, and one option will expire worthless, or the price will be lower than the strike price, and I end up buying some more shares. Either way, one side is a winner, and one side is a loser.

So how does the QUEEZE play look in this scenario?

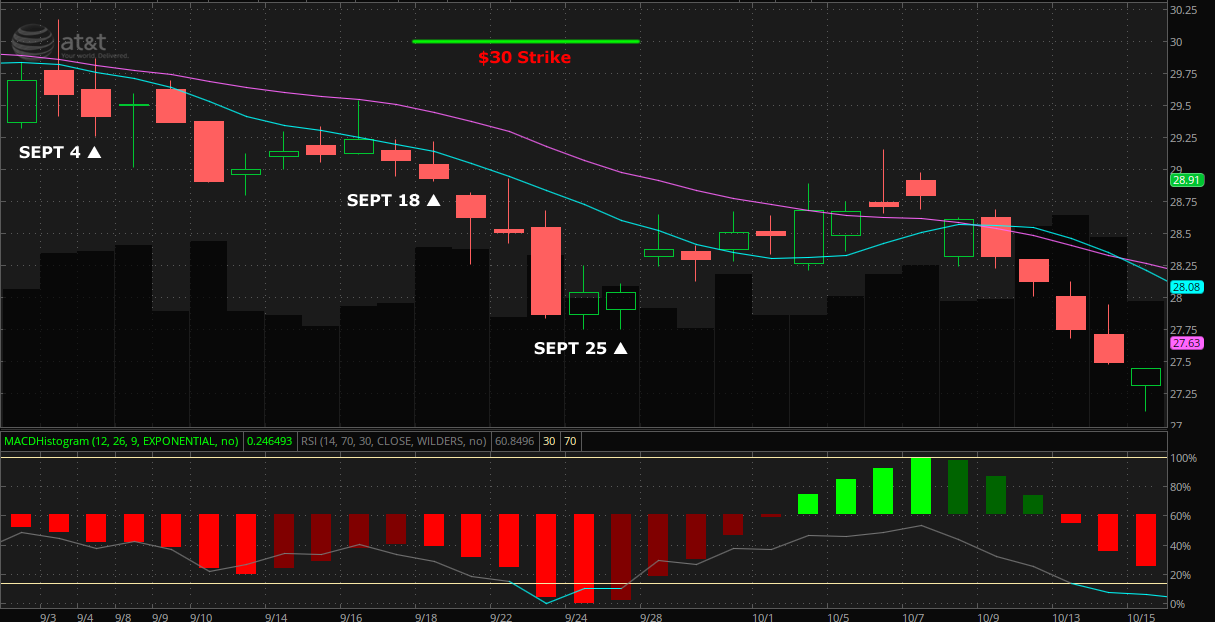

I sold 10 Calls for the $30 strike price for Sept 18th. Then, I also sold 10 PUTs also at $30 for a date further out, Sept 25th. At the time, I thought I was giving enough time for the price to recover, but I was wrong, very wrong. As you can see from the chart, the price swooned down, and plunged even further, making this prediction a big liability.

For the short term, this resulted in a 100% gain on the short calls, for a gain of $223, but a loss on the PUT side of things as I rolled the contract forward, rather than buying again, but took a hit of $1083 to be able to make the roll.

Surprise Error!

To make matters worse, somehow I managed to make 2 separate order sets while trying to roll the PUT contracts forward, and they both executed before I could cancel the other. I can still remember the sound that the software makes when an order executes, and I thought… “wait a minute, what just executed?”

Things get worse, because now, the stock price is so low, that I can’t even catch a bit for a $30 Covered Call scenario. They’re all at something like $0.02 or worse. So, the only play now is patience, and not panic. I had to take a step back, and think, regroup, and analyze what the best moves going forward would be. These are the “self talk” moments I went through.

- Don’t forget that overall, AT&T is a good company.

- One option is to continue to roll the PUT contracts forward, even if for months, to avoid being forced to spend on buying them in the short term.

- The pressure during this period prior to the US Election was one of uncertainty, and my gut feeling was, it’s going to get worse as the week of Oct 25th to 30th approaches.

- So “buckle up” and hang on. It’s too early to throw the towel in, so be patient, and try to enjoy the ride.

Why do I mention this sort of major screw up, even at this time? I could gloss it over, and pretend later as you see how this works out, that “I meant to do that.” Sort of like when you bounce a golf ball off a tree, and it somehow ends up on the green. Honestly, I didn’t mean to do this, but just buying my way out of the mess, and chalking it up to a loss at this point would guarantee the loss. Since the thinking process led me to believe that it’s not the end of the world, I think patience will allow me to work it out over time, and turn those PUT transactions into a profit.

WHAT CAME NEXT?

This chart extends the timeline all the way up until Nov 13th which is the last green bar on the right that closed the day at $28.92. It’s a long way from the $30 target we’ve been aiming for, but the trend is your friend, and it’s in the right direction for now.

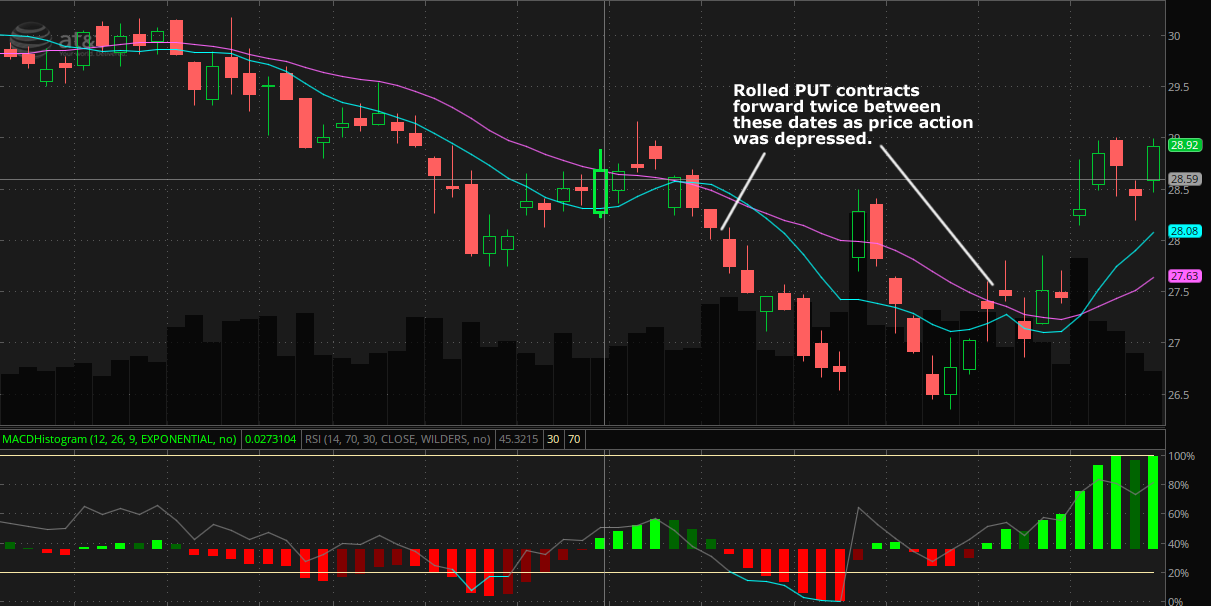

There was a period where the prices went back to where they were in April and May, right around $29, and even as low as $26.50 or so on October 29th. During this period, the prices of the PUT contracts were looking pretty ugly, and it was looking like I was going to have to answer the obligations for those errors back in Sept. As a stock price moves farther, and farther away from the strike, the person on the other side of those contracts can press a button at any time, and force me to buy them. This is something the “seller” or “writer” of the PUT contract has no control over. This forced a couple “rolling” moves to push things away from that eventuality.

A nice surprise happened after “earnings release” date in late October, and some upward pressure began to mount. This upward pressure was helped along by the perceived stability as the election came to a close.

This enabled me to roll the PUT contracts that had been rolled into November, further out, but with some actual gains, to December, and January. It also allowed for a Covered Call contract to be applied, so now there’s another “squeeze play” on for Jan 15th which as of the time of making those moves, is only 61 days away.

This is not yet complete, the story continues….at the end of November, I will add the logs to show how the October and November blocks work. October was a horrible setback, but we shall see if Novembers recovery was enough to get things back on track or not.