Naked Put selling is an effective strategy to contractually buy shares of something you are bullish on, probably want to buy, but want to get at a slightly lower price.

As is the case with all option contracts, the risks/rewards are different depending on which side of contract you are on.

With PUT contracts, the price will vary depending on the stock price movement. A stock price going up, will result in the PUT contract price dropping. The opposite of course is true that the contract price goes up if the stock price falls.

So how do you use a NAKED PUT SALE?

Let’s say you would like to buy shares in AT&T but you want an alternative to just outright buying the shares. If we look today at the price of AT&T, it sits at 28.91 and you think to yourself, I would like to buy it, but I want to only pay $28 per share rather than 28.91.

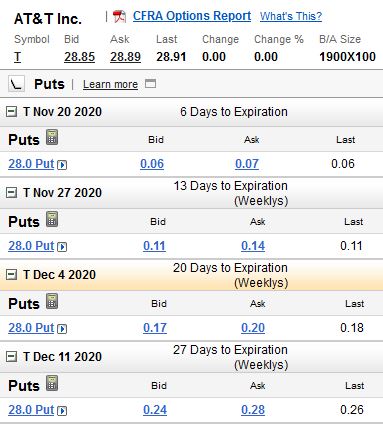

So you go looking at the market for prices on $28 PUTs. As you look at the PUT list, you will see that there are a range of prices from now until well into the future. Which one you choose will depend on how you feel things will work out.

This screenshot shows 4 different expiry dates for PUT contracts from Nov 20 to Dec 11. The further away we go, you can see that both the bid and the ask prices are higher as we move along.

For example, the Nov 20th $28 PUT is only 6 or 7 cents. This isn’t going to produce much of a premium, but depending on what your goals or instincts are, that doesn’t mean there’s not an opportunity here.

Remember, everyone in the market has different ideas on how they want to use these instruments. Some people have a bullish approach. Others have a bearish approach. Some are looking to “open” an option position at this time, while others are looking to close a position they have held for some time.

At the end of the day, you need to decide what you’re wanting to get out of this contract, and not worry about the others. If you think that entering the contract will benefit you in some way, then you do it without regard for how it might work out for the others.

EXAMPLE USING DEC 11th $28 PUT

For purposes of calculation

If we chose to act on the Dec 11th date, then we’re agreeing to a contract whereupon if the price of AT&T is BELOW $28 at the end of the day on Dec 11th, then we agree to buy it at that price. As part of the contract, you will be paid between .24 and .28 for each share represented in the contract.

Let’s say that somehow the price settled on is going to be in the middle. That seems to happen in my experience more often than not, so we will use $0.26 as the settlement price of the deal.

Since each contract is a value of 100 shares, that means, for each contract, 100 shares x .26 = $26 in option premiums paid from the buyer of the put to you in this case the seller. So you get to keep $26 in your account until Dec 11th until the expiry. If AT&T is below $28, you will automatically be “Assigned” the 100 shares at $28 meaning a total of $2800 will be invested.

What if the price is above $28 on Dec 11th?

Then you keep the $28 and nothing happens. The option expires worthless, and the person who bought the option is out $28, while you earned $28 just for taking on the obligation to buy in case it was below $28. This doesn’t sound like a lot of money, but it’s because we chose an option in a position whereby this particular strategy was a low-risk, low-payout scenario. Still, $28 in your pants is better than in the other guys pants don’t you think?

What if you raise the stakes a little, and do more contracts in a single sale? How many can you do? What Strikes, and prices can you negotiate? These types of limits are controlled by a few things. The amount of money you have in your brokerage account, the amount of “margin” they allow you, and the amount of risk tolerance you have for the potential loss that could happen if things turn horribly against you. (Like they did in March of 2020 for millions of people)

I have used AT&T for a while as an instrument to generate income. If you want to see the history of the ups and downs over the past few months have gone, I have put together a trading-log of moves to show how I reacted to the ever changing situation with AT&T.